A Comparison of the S&P 500 Index to the S&P 500 Equal Weight Index

Today I want to illustrate how a simple change to an indexing strategy can change can have a large impact on returns. We’re going to look at the difference between the S&P 500 and the S&P 500 Equal Weight Index.

What is the S&P 500?

The S&P 500 is an index of the largest 500 companies in the United States and is one of the most widely followed indexes in the world. So, when people say the market is up X points or down Y points they are usually referring to price changes in either the S&P 500 or the Dow Jones Industrial Average.

The S&P 500 is a market weight or value weighted index, which is not to be confused with value investing. A value weighted index means each company is purchased according to the size (market capitalization) of the company. Larger companies are given a higher weight in the portfolio.

What is the S&P 500 Equal Weight Index?

A decade ago, Standard & Poor’s released the S&P 500 Equal Weight index. Instead of weighting each company in the index based on its size, every company is given an equal weight in the index. It’s a simple change to the weighting formula, but changes the results drastically.

The Difference In Risk & Returns

The Standard & Poor’s website offers the past 5 years of daily data for free on their and a chart for comparisons of prior years on an annual basis. So, we’ll look at a few different charts as well as an excel sheet I’ve made to illustrate the differences.

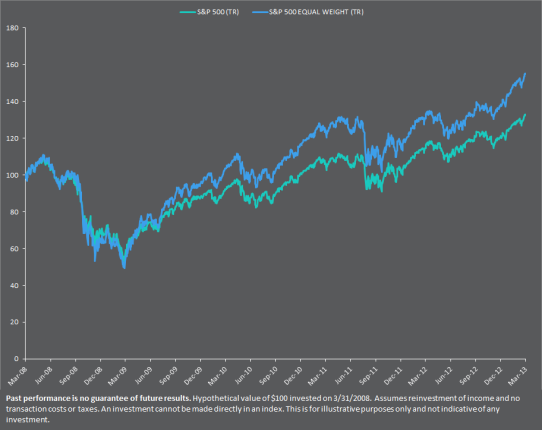

As you can see in this chart, over the period between March 31, 2008 and February 28, 2013, the S&P 500 Equal Weight Index outperformed the S&P 500. The S&P 500 Equal Weight ended the period with $150.52 and the S&P 500 ended the period with $129.28. This return can be broken down into the following statistics.

| S&P 500 (TR) | S&P 500 EQUAL WEIGHT (TR) | |

| CAGR | 5.1% | 8.5% |

| Standard Deviation | 19% | 23% |

| Sharpe Ratio | 0.25 | 0.35 |

| Correlation | 97.82% | |

The S&P 500 had a compound annual growth rate (CAGR) of 5.1% and the S&P 500 Equal Weight had a return of 8.5%, a difference of 3.4%. As we can see the standard deviation, which is a measure of risk, of the S&P 500 Equal Weight is 4% greater than the S&P 500. Despite this, the risk-adjusted return (Sharpe Ratio) of the Equal Weight index is 0.11 higher.

So, let’s break down what factors could be causing this differential in returns.

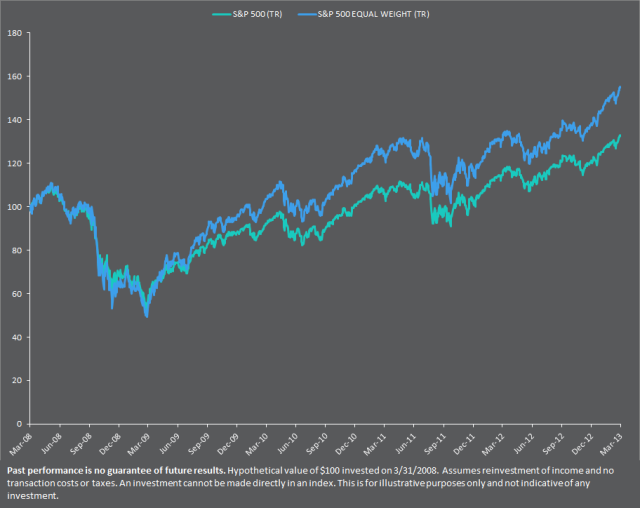

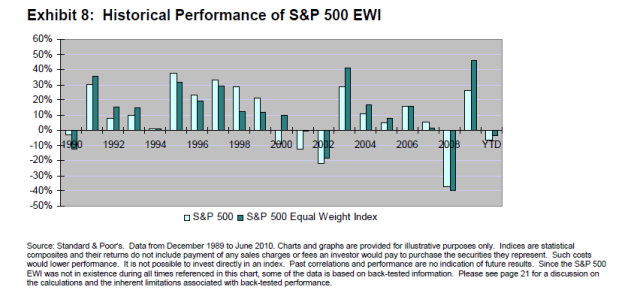

This chart details the returns of the two indexes over the past 20 years. chart, the S&P 500 Equal Weight index is slightly more volatile, having greater extremes in both directions.

Historically, smaller companies have outperformed larger companies. This observation is known as the size effect or size factor of stock market returns. In the value weighted S&P, the largest companies are given the highest weights, therefore losing out on this phenomena. The S&P 500 Equal Weight index involves buying proportional amounts of large companies and small companies, therefore the weight of a small company in the equal weight index is higher than the value weighted index. The S&P 500 Equal Weight Index’s greater allocation to small(er) companies causes the index to act as a blend between large cap and mid cap.

Despite the greater allocation to the smaller companies, over the past 5 years, the S&P 500 Equal Weight index maintains a 97.8% correlation with the S&P 500. This means it moves very similar to the S&P 500.

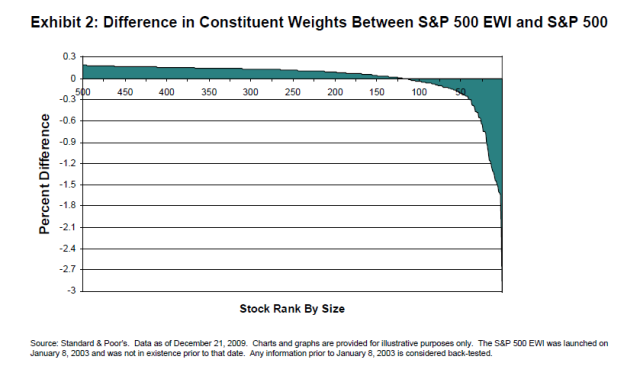

This chart from one of Standard & Poor’s resource manuals depicts the difference in company weights by size. The more dark green you see on the chart, the larger the difference in size. Namely, the smallest stocks on the right have a portfolio weight that is greater in the equal weighted index than the S&P 500 value weighted index.

The increase in returns can also be attributed to the automatic rebalancing of the portfolio that is in play here. By equal weighting the index, stocks are rebalanced on a quarterly basis when the index is reconstituted. Rebalancing makes sure companies are back at the target weight in the portfolio. This also has the effect of selling the winning stocks before they decline in price and buying the losing stocks when they are cheap.

Additionally, equal weighting does not discriminate between growth and value stocks. Therefore equally weighting the S&P 500 isn’t as likely to suffer when a certain strategy (growth or value) underperforms the market for an extended period of time. However, this also causes equal weighting to lose out on the potential benefits of a specific style of investing when that type of investing does well.

The Takeaway

The purpose of this post is not to advocate the use of an equal weight strategy over value weighted (market weight.) Instead I’d like for you to think about the principles involved in this example. Namely, rebalancing and diversification among different size stocks are important considerations to make when constructing a portfolio.

Even a simple equal weight strategy can improve returns by diversifying across different size stocks and rebalancing by selling the winners and buying the losers in a portfolio. However, like any strategy this is contingent upon being committed to the strategy through both good times and bad.

If you have any questions or comments, shoot me an email via the contact form or leave a comment below.

Disclosure:

Past performance is no guarantee of future results. An investment cannot be made directly in an index. This is for illustrative purposes only and not indicative of any investment nor is it a recommendation to utilize a specific investment. Consult a licensed investment professional before you make any investments. Investments in financial markets are subject to the risk of the loss of your investment principal.