What Everybody Ought To Know About TSP Lifecycle Funds

When it comes to managing investments, everyone’s needs are different. Your investment needs include:

- Your ability to deal with volatility in your portfolio

- Your income and growth needs

- The value of assets outside of your retirement account

- The allocation of your other investment accounts

- Tax minimization

- Your time horizon

An Impersonal Touch

Lifecycle funds only focus on one aspect of your investment management: you time horizon. As we discussed a moment ago, the amount of time you have left to invest is only one piece of the investment management puzzle.

The date you retire is the only thing you have in common with the other individuals in the Lifecycle fund, so the plan administrators need to make some assumptions about your personal wants and needs. They assume that the average investor is fairly risk averse, which means that they do not wish to take on very much risk. To accommodate this average investor, they put a very conservative tilt onto the portfolio.

Check Out The Video Overview

Here’s The Original Version Of The TSP Lifecycle Fund Video

Wait, That’s How My Money is Being Invested?

The TSP.Gov website allows us to view the investment strategy of the Lifecycle Funds over the lifetime of the fund.

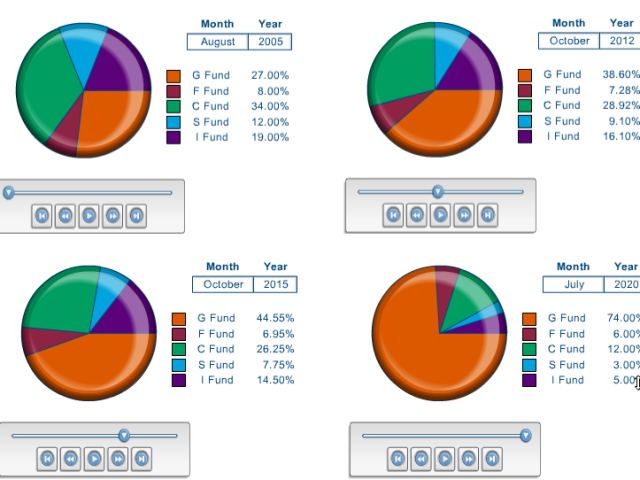

In this series of charts, we see the change in the 2020 Lifecycle fund between its inception in August 2005 and 2020, when the fund’s management ends. As you can see, by retirement, the fund’s assets will be 74% invested in the G Fund, which is government securities.

With the medical advances of recent years, most people should plan to have a 30 year retirement. The G Fund returned 2.45% in 2011. Inflation was 3% in 2011. Money invested in the G-Fund lost 0.55% of its purchasing power. Over the long-term, low returns from government securities will either shorten the life of your portfolio or drastically reduce the amount you can withdraw each year. To keep up purchasing power over the long-term, it’s wise to have much more exposure to equities.

What If Things Are Different When I Retire?

In the next few years, interest rates will most likely remain low. Interest rates are now at record lows and the Federal Reserve plans to keep rates low for the next several years. Low interest rates and stimulus money from the Federal Reserve will most likely keep inflation around 3% or higher.

This pressure by the Fed will help keep interest rates on government securities in the G Fund incredibly low, which will make it difficult for your portfolio to keep up with inflation. An asset allocation that is 74% government securities will most likely not even support a conservative income from your portfolio.

The TSP administrators say that Lifecycle funds are a smart and cheap way to manage your money, but this lofty goal falls short of its mark. The ultra conservative allocation that these funds will ultimately reach can hamper the survival of your portfolio throughout retirement.

To learn more about the TSP check out my post Government TSP: Overview of the Federal Thrift Savings Plan Funds.

Have Any Questions?

If you have a question about the TSP, investing or planning for retirement, please contact me.

Kevin Lundak

I am a 35 year old pvt in the army. Married and have no retirement started. I feel like being this late in the game. I should take a lot of risk, to catch up. Was looking at the TSPor USAA which is free to invest. $100 in Roth Ira and $200 in a mutual fund money market New to investing. Need help or advise. Hopefully this will get my wife off my back, making her feel better about our future! Thanks

Dieter Scherer

Hi Kevin,

I’m not sure how I completely missed this comment for so long! My apologies.

You’re still young and have quite some time to invest before retirement. It’s likely that our generation will be working quite a bit longer than previous generations (for health reasons, a new definition of retirement, fewer pensions, etc.) In regards to the TSP, when you are younger you can focus more on the I, C, and S funds, which are the equity funds in the account. It’s really about taking the right risks rather than being haphazard with risk. Unfortunately, the TSP is limited to only broad market indexes, so you can’t focus on value investments.

But for younger investors you can typically add a small-value tilt to your portfolio to help enhance returns over time. This is due to the factors of stock market returns, which typically reward an investor that invests in smaller stocks with higher returns over time and are more likely to reward an investor that invests in “cheap” stocks, i.e. value stocks, rather than growth stocks. So when you invest outside of the TSP it may be wise to take advantage of those aspects of stock market returns. Just make sure you are taking advantage of the TSP’s employer match. This is coming from memory here, but if I recall correctly, any contributions you make up to 3% are matched dollar for dollar and then match for $0.50 on the dollar up to 5%.

Hope this helps!

Best,

Dieter

Josh

I realize this is in response to a long-dead thread, however it was still a top return on my Google search for Lifecycle fund reviews. As an active military member Kevin would not get any government match until 2018, if he then elected to sign up for the Blended Retirement System. As it is, active military only receives a pension for 20yrs service, and the TSP was only opened up to us as a possible vehicle for investing, and to ease the transition when the eventual/inevitable changes will be made.

Norm from GA

I agree with everything you said, up to a point.

Indeed, Lifecycle funds are labelled for the decade one retires. However, if one chooses to invest in the fund labelled for the decade one plans to die, it all works out pretty well.

The “personal touch” most individually managed funds includes is usually an extra hand in ones pocket.

Dieter

I agree that in many cases, the financial advice investors receive from financial advisors may not be useful. It’s often the case that the financial advisor only knows a moderate amount more about finance than the client, which can often be a dangerous position. In my opinion, Lifecycle funds and most strategic allocation methodologies have caused draw downs far in excess of what is healthy for a portfolio, on the order of 30-50% during times of economic distress.

Patrick

Consider any supposed loss in G savings due to the G-to-inflation ratio as the insurance we virtually “pay” for the G fund’s stability during market down times. BUT inflation has been negative every month between Dec 2014 and Sep 2015 (so far) and G’s year-to-date return is 2% while all the other funds besides F are negative. Also consider the free 1% we get, PLUS the matching 3% we get which well compensates for any potential G-to-inflation loss.

John Stewart

Because the stock market is continuously manipulated by Wall Street Madoff- like players, any investment other than government securities is a gamble. The SEC is not big enough and the laws are not strong enough to protect the workingman’s investment in stocks. The insider trading and stock manipulation will always wreak havoc on your stock investments .