How Does Inflation Impact My Retirement Income?

Inflation can be a serious threat that will eat away your purchasing power over time if you don’t structure your investments in the right way.

Inflation acts like headwind that we are constantly fighting against. You really need to consider the effects of inflation when you are constructing a portfolio, so that your constant income stream doesn’t end up buying you far, far less in the future.

Having a stable $50,000 annual payment sounds great until you realize that after 30 years, it’s likely to be worth about $18,000 in today’s dollars. So when you are structuring your portfolio, you really need to keep your eye on not only protecting the principal you need over the next few years, but also maintaining purchasing power,

Many individuals do not consider their purchasing power when they make an investment, especially income-based investments such as annuities.

So, first of all, I think it’s important to determine what inflation is and how it’s typically measured.

What Is Inflation?

Inflation is the increase in the general price level of the goods and services most Americans purchase each year. To get a better grasp of this, let’s do an example.

Say you can purchase a loaf of bread today for $1.00. Over the next 12 months, we have inflation of 5%, that same loaf of bread would cost $1.05. So $1.00 next year can no longer buy the same amount of bread. In fact, if you compare it to the value of $1.00 today, you’d realize that $1.00 in a year, at 5% inflation, would only be worth$0.952 (95.2 cents) in today’s dollars.

As the price level of goods in the economy increases the every dollar we have can buy less of the same goods and services.

How Do We Measure Inflation?

Inflation is measured each year by the Bureau of Labor Statistics. It’s calculated off of the change in the Consumer Price Index, which measures the general price level of the core goods and services Americans spend their hard-earned cash on.

Any pensions or annuities that do not increase the income stream with a cost of living adjustment each year will have their purchasing power eroded over time. Fortunately, Social Security offers a cost of living adjustment for recipients, to learn more about how to maximize your Social Security, sign up for email updates at the bottom of this post.

Here’s a video overview of inflation and the results of the inflation study.

The Results Of The Study

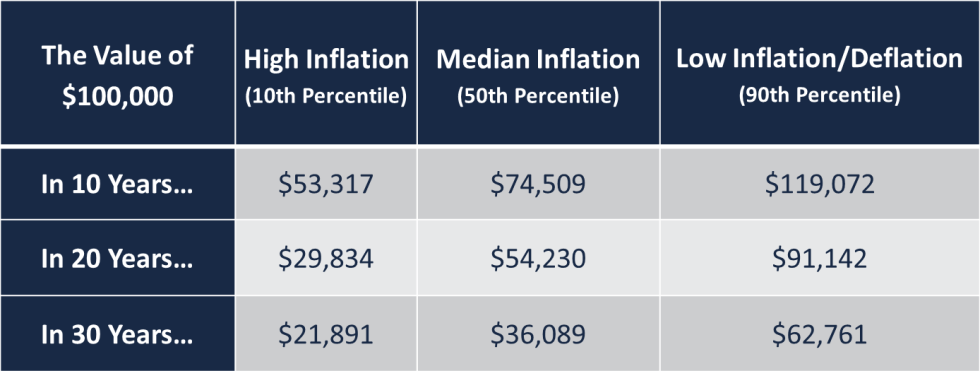

To determine how inflation impacts an income stream over time, I’ve created an Excel calculator. The calculator uses historical CPI data from 1914 to 2012 to determine how much a dollar will be worth after 10, 20 , and 30 years. The results of the study are summarized in the following chart.

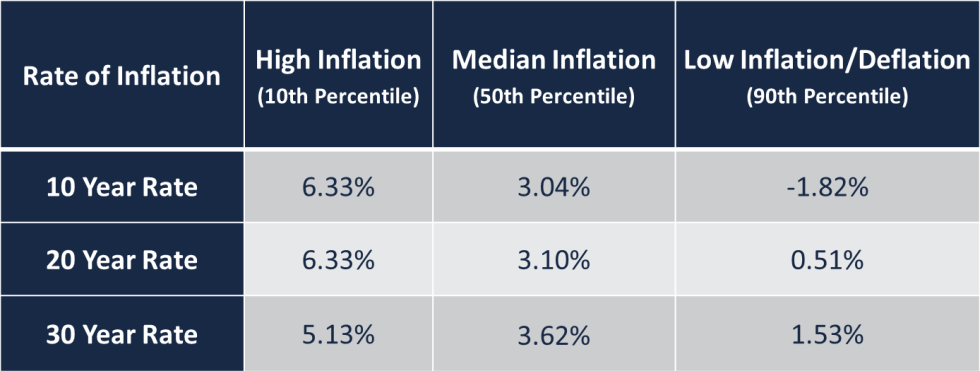

Here are the median, high and low inflation rates. (Note: Due to rounding and percentile midpoints the rates below may not exactly correspond to the values above.)

After 10 years the median inflation-adjusted value of $100,000 is only $74,509. After 20 years that same $100,000 in the median scenario will only buy you $54,230 worth of goods in today’s dollars. Finally, in 30 years in the median scenario your $100,000 will only buy you $36,089 worth of goods. That’s a loss of about 64% of your purchasing power!

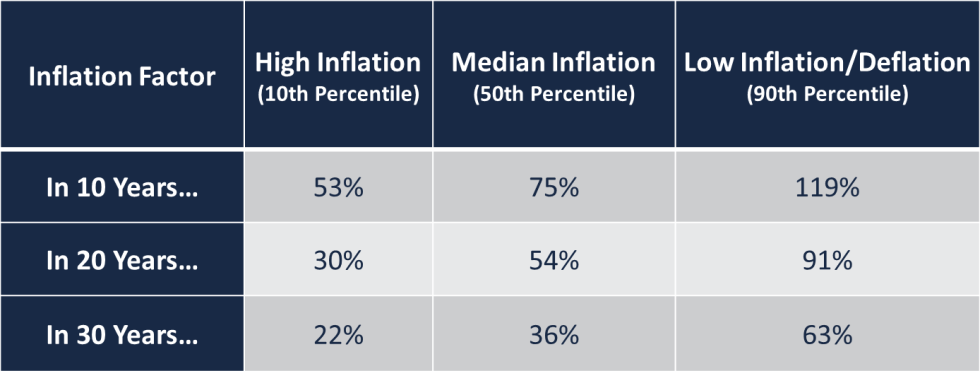

I’ve taken the value of $100,000 over time and converted that into an inflation factor. If you’d like to see what an income stream of $200,000 has historically been worth under a high inflation scenario after 20 years, simply multiply the inflation factor in that row and column (in this case 30%) by the income stream ($200,000) to get the answer ($60,000) in today’s dollars.

As you can see, inflation can severely impact your lifestyle if you do not take the proper steps to safeguard your portfolio against inflation.

If you’d like more posts like this delivered right to your email inbox, sign up for email updates and get on the list for Retirement Planning Academy when it goes live (soonish.)

Photo Source In Video: Copyright by Moyan Brenn

Photo Source In Post: Paolo Camera