The Roth IRA: The Basics

Saving for retirement can be a big headache and because of all the restrictions on withdrawals it’s tough to know whether to invest in tax deferred (qualified) accounts for your retirement or to invest more in a brokerage account, which gives you more flexibility with your funds.

The Roth IRA was first created in Taxpayer Relief Act of 1997 and is named for the Delaware Senator that sponsored the bill, William Roth. The Roth IRA allows Americans to make a tradeoff. Instead of receiving a tax deduction today for their contribution to an IRA and paying taxes on the account when they retire, contributions are taxed today and the tax payer never again pays taxes on the money in the account.

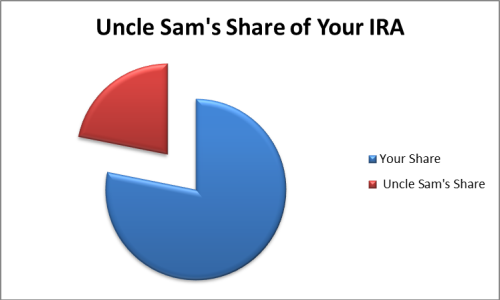

A Traditional IRA is a great way to save money for retirement, but as you earn money on your investments, Uncle Sam’s portion of your investments increases as well. Not only that, but distributions from a Traditional IRA are taxed at your ordinary income tax rate instead of the lower capital gains rate for long term investments.

If you are in the 28% tax bracket during retirement, the IRS would own this much of your Traditional IRA

Basically the IRS acts like a joint owner of your account and they are paid out their share once you retire and begin withdrawing funds.

Roth IRA’s are a great way to pay the government first and then reap all of the benefits of your savvy investments by yourself when you retire.

Now before you go out and sign up for a Roth IRA immediately, there are some ground rules for its use.

Contribution Limits

In 2012, taxpayers under 50 can contribute up to $5,000 per year to a Roth IRA.

Taxpayers over 50 are allowed an extra $1,000 per year “catch-up” contribution, for a total of $6,000 per year.

Income Restrictions

Just like a Traditional IRA there are income restrictions that limit a taxpayer’s use of a Roth IRA if their income is above a certain level.

If your taxpayer filing status is Married Filing Jointly and your combined income is less than $173,000 per year you can contribute the maximum allowed contribution. This contribution is phased out between $173,000 and $183,000, and you cannot contribute any money to a Roth IRA if your income is above $183,000 per year.

Those that are Married Filing Separately are hit hard with restrictions, they can’t make any contributions if their income is above $10,000 a year. Ouch!

The table below summarizes the limits for the different filing statuses.

|

Taxpayer Filing Status |

Phase-Out Limit |

|

Married Filing Jointly |

$173,000 to $183,000 |

|

Single/Head of Household |

$110,000 to $125,000 |

|

Married Filing Separately |

$0 to $10,000 |

Distributions

Roth IRAs offer some compelling distribution options if you should need your money before you retire. Under a Traditional IRA, if you need money from your IRA before age 59.5 you will be taxed at your current income tax rate plus an additional 10% penalty tax. Pre-retirement age distributions from a Roth IRA are treated a bit differently.

Any contributions you make to a Roth IRA can be withdrawn at any time tax free. Because you have already paid the taxes on your contributions, you will not be hit with a penalty tax nor will you be hit with any income tax.

Contributions are assumed to be withdrawn first from a Roth IRA, so if you need any money, you can withdraw money tax free from your Roth IRA up until the amount of total contributions you have made to your account.

After all contribution money has been withdrawn, any money from a Roth conversion is assumed to be withdrawn. If you are still under 59.5 and you have converted money from a Traditional IRA or employer sponsored plan within the last 5 years, the converted assets will be subject to a 10% penalty upon withdrawal. If it’s been longer than 5 years since you converted your assets, you can withdraw them tax and penalty free.

Finally, earnings are withdrawn last from the account. Earnings may be subject to a 10% penalty tax and to income tax if the distributions are not deemed to be a “qualified” distribution. So it is not wise to remove any earnings in your account before 59.5 unless you have a very specific and dire need for the money in your account.

Required Minimum Distributions

Unlike a Traditional IRA, a Roth IRA has no required minimum distribution (RMD) once you reach age 70.5. With a Traditional IRA, the government doesn’t get its share until distributions start, so Congress implemented the RMD restriction so that the IRS could tax you at some point before you died. RMDs allow the government to know it will get its share of money in your retirement account once you reach age 70.5.

Roth IRA contributions are made with after tax dollars. Since you’ve already paid the government its share it doesn’t need you to withdraw funds from your account. With a Roth IRA, you’ll have way more flexibility when drawing from your accounts during retirement. No deadline to withdraw your funds makes retirement planning much simpler.

While this should give you a working knowledge of the Roth IRA, it is not a comprehensive guide. There are many topics that I could cover about the Roth IRA. Whether to convert a Traditional IRA to a Roth IRA, qualified distribution rules, and much more would require more in depth answers.

I’ll be sure to include more about the Roth IRA in future posts, but I hope this post provided you with a good amount of educational value.

Photo Source: Philip Taylor