What Type of Investment Account Should I Use?

What is a Qualified Account?

- Qualified investments are investment accounts given special treatment by the IRS. Assets within the account are allowed to grow tax-deferred, until the taxpayer begins withdrawals during retirement. Generally, taxpayers can make tax-deductible contributions to the plan. 401(k)s and IRAs are examples of qualified accounts.

What is a Non-Qualified Account?

- Non-qualified investment accounts are any accounts that do not satisfy the definition of a qualified plan put forth by the Internal Revenue Code. While qualified plans offer some form of income tax deduction or deferral of taxation to a future period, non-qualified investments do not offer such benefits. Any dividend or interest earned on an investment is taxed in the current year, as are any capital gains or losses. There are no tax advantages to non-qualified accounts.

While it may seem useful to always utilize qualified investments, there are several shortfalls:

- You generally cannot take withdrawals before you reach retirement age. Most qualified retirement accounts will penalize any withdrawals the taxpayer makes from the account, before the taxpayer reaches retirement age. This penalty, which is generally 10% of the value of the withdrawals, must be paid in addition to the taxes that the taxpayer will incur in the year that the withdrawal is made. Therefore the funds in these accounts are not easily accessible and other means should be exhausted before this option is considered.

- If income taxes increase in the future, you may end up paying more on your earnings than you otherwise would have. Currently, dividends and capital gains are taxed a rate of 15% (most likely 20% next year), however, all distributions from a qualified account are taxed at your normal income tax rate. If tax rates increase in the future, you may end up paying more in taxes on a qualified account than a non-qualified. One potential solution to this is to use a Roth IRA or Roth 401(k), however, the disadvantage to such retirement vehicles is the inability to deduct contributions in the current year.

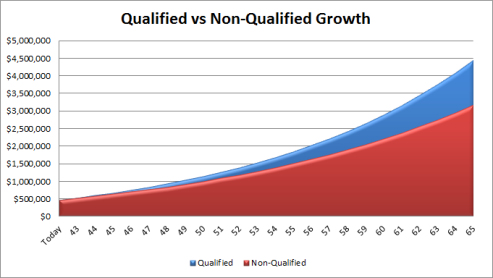

Growth of assets over 25 years.

Still, nonqualified investments offer a great benefit to an investor. The flexibility and ease of access to these funds is can be an acceptable trade off to the tax benefits you’d get in a qualified account. There are numerous tax strategies that we can use to reduce the realization of capital gains and limit the amount of dividends an investment receives in a given year. This can limit the taxes you owe to Uncle Sam in the current year, allowing you defer taxes to a following year when it could be more advantageous to sell. It’s a smart idea to use a brokerage account for most purchases or goals you have before retirement. The liquidity offered by non-qualified accounts can be tailored to the goal for which the taxpayer is saving.

Photo Source: Ano Lobb

One thought on “What Type of Investment Account Should I Use?”