Financial News Friday – April 5, 2013

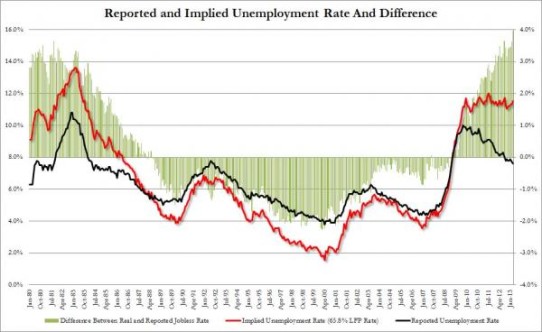

Real March Unemployment Rate: 11.6%

Zerohedge has a nice piece on the difference between the reported unemployment rate, which was 7.6% and the real unemployment rate of 11.6%. The chart above is an excerpt from the article.

Canada’s Economic Action Plan For 2013

Canada has released its economic action plan for 2013, titled Jobs Growth And Long Term Prosperity. While most of the material contained therein is your standard government economic planning, page 144 reveals an interesting insight. A depositor bail-in procedure for large banks has been implemented. The procedure allows for “the very rapid conversion of certain bank liabilities into regulatory capital.” This provision will likely allow Canada to utilize depositor funds in excess of the insured amount to be used to bail out the banks, namely the same procedure that was recently performed in Cyprus.

Read Canada’s Economic Action Plan For 2013 (PDF)

Does the Crypus ‘Bail-In” Open The Door For Private Deposit Insurance?

In the Eurozone, large uninsured deposits held in banks are sure to cause depositors to pause and reevaluate their risks. This could lead to a new form of insurance cropping up, where depositors could pay insurance premiums to insure their large deposits. Obviously, the banking system in the Eurozone is in a precarious position. However, private deposit insurance could be a good thing for the banking system in the Eurozone. Private insurance companies would likely subject banks to exhaustive stress tests which may uncover risks that central bank stress-tests would gloss over. Banks deemed risky by insurance companies would likely see a reduction in deposits. This could cause banks to shore up their balance sheets and become less risky to attract depositors.

Read The Article At Yahoo Finance

10 Things Financial Advisers Won’t Say

Here’s a good read that describes the practices of a typical financial salesperson at a major firm.

Read The Article At MarketWatch

Only a Tiny Percentage of Americans Opposed to Breaking Up Big Banks

50% of Americans favor plan to break up the 12 largest banks in the country in an effort to remove financial institutions that are deemed too-big-to-fail. 23% of Americans oppose the move to break up the banks.

Read The Article At The Big Picture

Here’s Why Stock Market Investors Should Be Nervous

Things should be interesting over the next 12 months as money comes pouring in from investors that believe the stock market is “safe” now that the recession is a couple of years behind us. By no means is it a bad time to invest, but remember to be careful and don’t expect the same returns going forward as we have seen in the recent past. Despite the declarations of most news organizations, who often interview overly optimistic analysts, who in turn use overly optimistic measures of the market…the market is getting expensive.

Read The Article At Yahoo Finance