Financial News Friday – August 8, 2014

Bull Markets 1871 to July 2014: Duration and Magnitude (Greenbackd)

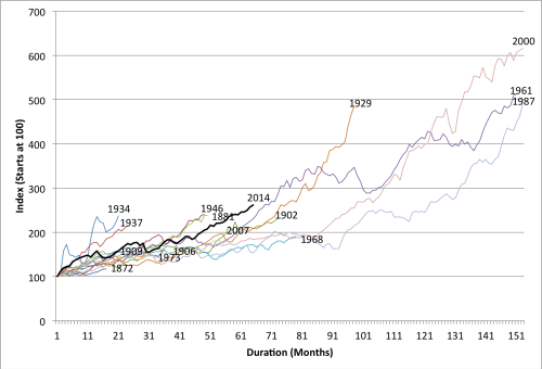

To put the current market into context, here’s a post by Toby Carlisle about the length of bull markets (the graph is featured above). In the post he shows the length and cumulative returns of various bull markets throughout the S&P Index’s history (using Robert Shiller’s database to go back to 1871). Here’s what he has to say:

“I don’t believe that there is anything predictive about the duration or magnitude of the average and median bull markets. I only include that information to contextualize the present market. In that sense, it is decidedly average, if a little long in the tooth. It has delivered about 9/10ths of the gains of the average, and lasted a few months less. It has run 11 months longer than the median, and generated 120 percent of the return. Only the bull markets ending in 1929, 1961, 1987, and 2000 returned more (in each case, much more), and lasted longer (in each case, much longer). Two other bull markets lasted longer–those ending in 1902 and 1968–but neither returned as much as the current one.”

HBO Used To Hate Netflix, Now It Wants To Be Just Like It (Quartz)

Rupert Murdoch and Fox have recently withdrawn the $85 per share bid for Time-Warner (currently trading around $73). Now, Time Warner needs to generate the same amount of value for its shareholders through other means. One of Time Warner’s crown jewels is HBO, the purveyor of some of the most popular (and pirated) shows in pop culture. Now, with the buyout off the table, one method to generate such value is for HBO to release its popular HBO Go internet streaming service as a standalone product.

Currently, HBO Go only comes with an HBO subscription and HBO subscriptions are only provided via packages from cable and satellite providers. These package deals offer higher profit margins for HBO subscriptions, but limit the service’s reach to only those who already have or desire a cable subscription. Uncoupling the products is a scary prospect for Time Warner in the near-term, as it could lose those lucrative deals, but over the long term, HBO Go could rival Netflix in its users, as it already has many of the necessary content and original programming deals in place.

New Buying Strategy as Facebook and Google Transform Into Web Conglomerates (NYTimes)

The purchase of start-up tech companies by the Yahoos, Apples, Facebooks, and Googles of the world has been one of the more interesting phenomena of the past few years. Start-up companies that have quickly growing user-bases have been scooped up for unheard of prices.

Instagram (the photo sharing service) was purchased for $1 billion, Oculus Rift (a virtual reality headset manufacturer) for $2 billion, Whatsapp (an instant messaging service) for $16 billion, and those are just a few of Facebook’s purchases.

Google has purchased Twitch for $1 billion(a competitor to Youtube in the live-streaming of videogame gameplay), Waze for $1.3 billion (social road map alerts), Nest for $3.2 billion (in-home automation), several biotech and bioinformatics companies, and around a number (maybe 8 or so) of the best robotics companies, including Boston Dynamics.

Just a note, with prices such as these and almost zero revenue streams to boot, there’s likely a bubble in the social app space, an idea that even Fed Chairman Janet Yellen believes. These companies are selling much like tech companies in the late 1990’s that sold for outsized valuations simply because they were a dot-com. While some of these projects will pan out and be fantastically successful, others won’t and they’ll be swept into the dustbin of history. At any rate, the tech giants are currently flush with cash and are thus on an acquiring spree. This indicates they are trying to diversify their product lines and stave off their core products’ eventual obsolescence.

However, this trend could continue even after any potential social app bubble bursts. If that were to come around, these companies (Google and Apple at any rate, Facebook usually funds its purchases almost entirely with stock) would be able to purchase future start-ups at more reasonable prices, which could cause these tech titans to become even more conglomerate-like, with tendrils in multiple industries.

The author also points out that conglomerates, once plentiful in other industries, are an endangered species. In other industries the diversified business segments are better off broken up so that no cash is wasted.

However, computationally driven companies (such as biotech as robotics) and Google go together quite well, as its core product, search, is powered by advanced neural networks. To Google these projects are essentially lottery tickets (or moonshots as they call them) that could pay off big in the future.

Anyway, it’s these types of dilemmas that make tech companies difficult to invest in for the long term. The tech space simply changes so quickly. So if you like to invest in companies such as these, I think it’s safer to utilize a momentum strategy, or to simply buy them when they are dirt cheap bargains, such as after a huge sell-off due to bad press.

The Proper Care and Feeding of Your Spoiled 23-Year-Old (Bloomberg)

The article opens with “Rich people have enough money to solve almost all their problems but one: children who grow up to be entitled, materialistic and unhappy slackers.” Edward-Pitt a financial advisor, warns that while giving the maximum tax-free gift to your children each year ($14,000, or $28,000 per couple per year) makes for savvy tax advice, but it could hamstring their development as productive adults in the business world.

Credit Scores Could Rise With FICO’s New Model (NYTimes)

FICO, the organization that administers the FICO credit score, has created a new iteration of its score that places less emphasis on unpaid collections resulting from medical debts. For those whose scores have been tarnished only by unpaid medical debts that were ultimately settled or paid, “you could expect to see your score go through the roof”. Others with previously unpaid medical debts mixed with other collections could see a modest bump in their score of around 25 points.

As Marijuana Becomes Legal, a Hedge Fund Looks to Profit (ThinkAdvisor)

An investment manager plans to open a hedge fund to invest in marijuana companies.

The products of such companies would include growing marijuana itself, health products derived from marijuana, and investment in ancillary companies that may produce the necessary infrastructure for marijuana production.

Targeted companies would include those being brought to the US financial markets through shell corporations (reverse mergers). Reverse mergers account for up to 95% of this market. A reverse merger occurs when a shell company, a public company with no operations, purchases a privately owned company, which reduces the red tape to become publicly traded. This simultaneously causes the price of companies not yet completely ready for public trading due to structural issues to rise and fall with the whims of investors.

This aspect of the market is highlighted in the following excerpt:

“We’re going to look for the companies that have real assets but have capitalization and structural issues, issues surrounding being public because they didn’t understand what they were getting involved in. We’ll look for the ones that could use our help.”