Financial News Friday – June 20, 2014

Fed Chairman Janet Yellen To Market: Don’t Be So Sure of Yourself (WSJ)

Uncertainty was the word of the day for this past Wednesday’s press conference. Yellen makes no guarantees about the future of interest rates and says that the future course of interest rate policy will be dictated by the state of the economy. Yellen goes on to comment that the Federal Funds rate target interest rate is likely to be raised sooner rather than later.

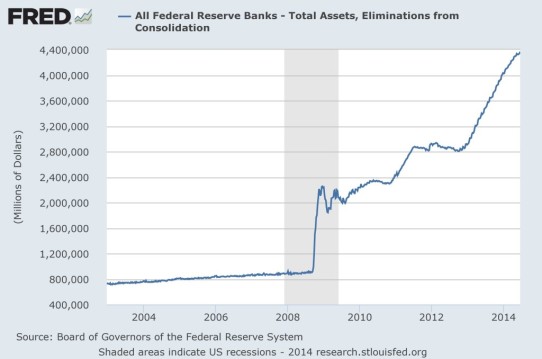

Over the past 6 years the Fed has purchased around $3.6 trillion dollars (see graph above),in Treasury bonds and mortgage backed securities, amounting to a total of around $4.4 trillion in total assets. This bond buying spree has driven interest rates down and buoyed the stock market.

Over the next few years we’ll all have front seats to the results of the biggest financial experiment in market history. It may be a good time re-examine your risk management strategies.

Aereo, Broadcasters Await Supreme Court Ruling (LA Times)

Aereo is a company that allows you to stream local channels through the internet by paying a small monthly fee to rent an antenna from the company. Aereo, unlike cable TV companies, does not pay the Networks retransmission fees.

Retransmission fees from cable companies amount to billions in dollars of revenue each year for the likes of Fox, CBS, NBC, and ABC. The Networks have taken issue with this threat to their current paradigm and the ensuing lawsuit and its appeals have brought them to the steps of the Supreme Court.

A ruling on the issue is expected soon and it could have a big impact on all parties. If the decision goes Aereo’s way streaming video companies could stream live TV over their services and the Networks could lose much of the revenue from their retransmission fees. This decision could really upend the television industry.

Exit Fees for Bond Funds? (Investment News)

This is unlikely to happen, but the Fed, of all entities, has suggested to the SEC to levy an exit fee on bond funds to help stem the oncoming retail investor exodus out of bonds, once rates start to rise. This would work like a redemption fee wherein an investor is charged a percent (usually 1%) if it leaves the fund within a set period of time. I don’t think holding investors hostage with fees is the way to go, fortunately, neither does the SEC.

A Tech Perspective Of The IRS’s Destroyed Emails (ZDNet)

If you’ve been following the IRS scandal over the past year a new revelation has been brought to light. The IRS destroyed the hard drives of several employees key to the investigation after those hard drives crashed. The simplest answer seems to be that the IT staff at the IRS is utterly incompetent.

Their data retention policies allowed for only 500 megabytes of emails to be stored on servers. After crossing that threshold employees were advised to archive emails on their local computers. That of course, opens them up to tampering. Important documents were to be printed out(!) and the recipients handwritten on the document.

In 2011, before the ‘upgrade’ employees were only allowed to save 150 megabytes of emails (check your own email account for a personal metric on just how small that is.) When the employees’ hard drives crashed, and were disposed of, there was no backup of the data. An agency tasked with data collection and a budget in the billions, thought it would be a good idea to save $200,000 by not adding the necessary storage to keep its own email records.

Detroit Rolls Out New Hybrid Plan (Yahoo Finance)

After months of debate with unions, Detroit has opened a hybrid pension plan in an attempt to save a plan it simply cannot afford. Current pensioners will are likely to receive between 73% and 100% of their promised benefits.

Active workers will still have a defined benefit plan, albeit a much less generous one (continuing the previous benefit was completely impractical from a budgetary standpoint.) However, the city is no longer required to fund the shortfall in the pension plan if the investments do not meet the required rate of return to fund promised benefits.This allows the city of Detroit to contribute a fixed amount and no longer have to worry about expending more funds on the plan if markets don’t behave as the plan managers hope they will.

Advisers Turn to Alternative Mutual Funds on U.S. Rate Rise Fears (Reuters)

It looks like advisors are looking for different strategies to hedge their clients’ portfolios against future rising interest rates. Hedge funds are currently scrambling to come up with liquid mutual fund or ETF funds that offer access to long/short strategies, managed futures (commodities & derivatives trading), and private equity.

I believe active investing, when done right, can be very valuable to clients in the long term, however, it’s difficult to test the robustness of these funds because you don’t have access to the underlying data or the data for a new fund is only backtested a handful of years. Unfortunately. as is the case with many financial products, we’re also likely to see a legion of advisors recommending alternative funds to clients that the advisors may not understand to begin with.

So, over the next few years, this will likely lead to a lot of uneducated money going into anything labeled an alternative strategy. I’d wager this trend is going to end badly for investors.

Amazon Launches Its Own Phone. Uses AT&T (Extremetech)

I’m surprised that the price-point for the phone is so high (starting at $200 under contract and $650 off contract), considering that’s the type of profit margin (perhaps 50%) you’d expect to see on a normal phone. With Amazon usually offering hardware at razor thin margins, the high price of the cell phone is odd, especially due to it being in the middle of the pack for performance among premium priced phones.

The 3-D effect seems a bit gimmicky, as it isn’t true 3-D, it just shifts the screen a bit as you move the phone around. The big potential winner in the phone is the Firefly app, which allows customers to take a picture of object, sans barcode, and then buy it on Amazon. A cool feature, I’m just not sure how much use it will have as I recall several other apps of the same variety that have come and gone.

At the end of the day, it seems to target less savvy tech users who prefer simplicity, love buying things through Amazon, and use AT&T.

Betterment For Advisors On Its Way As Firm Adds Trust, Tax-Loss Harvesting Products (Investment News)

In an interesting development, low-cost online investment management firm, Betterment, is opening a platform for advisors. Advisors will be able to access the firm’s index fund investment platform as well as its tax-loss harvesting and trust fund services.

I’m far from an ardent believer in efficient market theory and the efficacy of passive investing, so I’m not likely the type of person they are looking for. However, this may actually be a good idea for advisors who focus solely on passive management and wish to focus on financial planning.

Their current investment management services are being commoditized and therefore it behooves them to delegate the least valuable part of their practice to a more efficient firm.

Other Updates

I ended up heavily renovating part of the website’s new features, so the preview had to be delayed. Once I’m satisfied with the new look and features of the website, I’ll start rolling them out from my test server to the live site. Additionally, over the next few weeks I’ll be revisiting a lot of the videos I’ve uploaded in the past and updating them with new content.