Financial News Friday – June 21, 2013

Michael Kitces has an excellent breakdown of advisor designations that crux of the issue and separates the worthwhile designations from the worthless. He breaks down the recent study by the Consumer Financial Protection Bureau, which identifies 50 different designations and the confusion that arises from such a broad and questionable spectrum. He puts forth the argument to have the Certified Financial Planner designation as the starting point, which would help eliminate the specious (read: worthless) designations that would not additional value to clients. (Nerd’s Eye View)

Baby boomers have continually underestimated the massive healthcare costs they are likely to experience during retirement. A Nationwide Financial survey found that boomers over 50 estimate they will pay $79,000 per year for nursing home care when they need it. However, another Nationwide study indicates that the cost of nursing home care could rise to $265,000 per year by 2030, which is around the time most baby boomers will require aid. (AdvisorOne)

A post on the FPA (Financial Planning Association) blog poses the excellent question, “Are you an investor or a speculator?” The difference between investing and speculating (gambling), is the basis upon which you make your investment decisions. An investment approach could include the analysis of macroeconomic factors, a breakdown of the fundamental drivers of a company’s or market’s growth, qualitative checklists, or other quantitative variables. If you are not basing your decision on empirical evidence, chances are you are speculating. (All Things Financial Planning)

Retirement is a time when many people begin to volunteer more in their community. Volunteerism is an excellent pursuit and contributing to our communities can really make a difference in others’ lives. However, without careful planning, directors and members of boards can be held personally liable for damages arising from the activities of members of the organization. To protect your well-earned wealth, make sure your organization has adequate director’s and officer’s insurance and check your own umbrella liability insurance policy to see what is covered. (AdvisorOne)

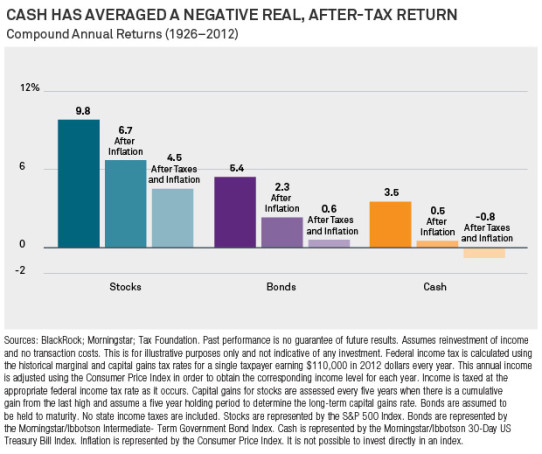

The chart at the top of the post was created by Blackrock to demonstrate the difference in returns of stocks, bonds, and cash after taxes and inflation. As you can see, over the past 86 years, the cost of holding cash, after taxes and inflation, has been negative. Click the image to zoom. (Blackrock)

Also, it’s my sister’s birthday today, so I can’t end this post without a shout out to my sister. Happy Birthday Christina!