Financial News Friday – May 10, 2013

Back again this week. Last week I was on vacation and was unable to post a weekly update. Also, expect some new content and videos to start hitting the blog next week.

Challenge to Dogma on Owning a Home

I haven’t yet read the study, but I may give it a read to understand the methodology. “A new study by two economists concludes that rising levels of homeownership in a state “are a precursor to eventual sharp rises in unemployment in that state.” As more homes are owned, in other words, fewer people have jobs.” An interesting thought.

Read The Article At Yahoo Finance

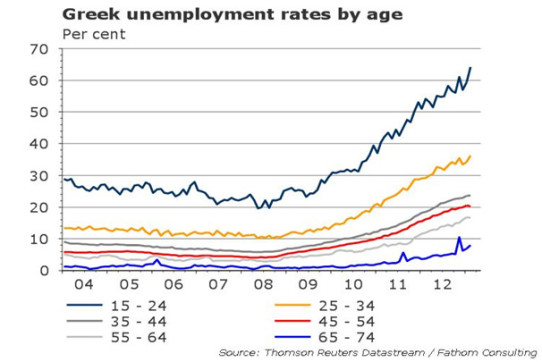

Almost 2/3 Young Greek Jobseekers Unable To Find Work

The chart at the top of this post is from AlphaNow detailing the rise in unemployment for Greeks of various age groups. The unemployment for Greek youth is sitting around 64%.

Spender Or Saver? The Choice May Not Be Yours

Behavioral finance is one of the more interesting aspects of investing and financial planning. The choices that individuals make based on their unconscious habits have far reaching consequences throughout their lives. This article delves a bit into the impact that childhood socioeconomic circumstances have on individuals during a recession.

In the study they find that participants that grew up with lower socioeconomic status were “more impulsive, took more risks, and approached temptations more quickly afetr thinking about an ongoing recession,” whereas those who grew up with higher socioeconomic status were “less impulsive, took fewer risks, and approached temptations more slowly.”

Read The Article At MarketWatch

Monitoring The Financial System

Today, Ben Bernanke has a speech about how the Fed aims to monitor the financial system. I’ve read through the prepared copy of the speech and here are a few highlights:

“To be sure, a favorable overall environment reduces credit risk and strengthens balance sheets, all else being equal, but it could also reduce the incentives for market participants to take reasonable precautions, which may lead in turn to a buildup of financial vulnerabilities.”

“So, what specifically does the Federal Reserve Monitor?”…Systemically Important Financial Institutions, Shadow Banking, Asset Markets, and the Non-financial Sector

Systemically important financial institutions are “firms whose distress or failure has the potential to create broader financial instability” Colloquially known as too-big-to-fail firms.

“the Federal Reserve…will monitor…regulatory capital, leverage, and funding mix.” He goes on to mention that the Fed will stress test these firms through a set of “highly adverse economic and financial developments.” Many of the tools he mentions that will be used to stress test firms are still under development.

With regards to asset markets…” we are less concerned about whether a given asset price is justified in some average sense than in the possibility of a sharp move”

Read The Speech At The Federal Reserve

Pharma’s Failure: Drug Spending Finally Declines

Brand name drug spending decreased by $11 billion between 2011 and 2012, as growing number of brand-name drugs have had their patents for their drugs expire. Bad news for big pharma, good news for the consumer.

Read The Article At Yahoo Finance

Poll: What Poses the Greatest Threat to Global Equity Markets?

The CFA Institute asked its readers, “What is the greatest threat to equity markets?” 37% stated global economic slowdown, 24% stated less accomodative central bank monetary policy, and 15% stated exogenous systemic shock (war/natural disasters). Read the rest of the results over at the CFA Institute’s blog.

Read The Article At Enterprising Investor

Upper-classmen? Study Shows Colleges Taking From the Poor, Giving to the Rich

An interesting way to frame the trend of increasing the number of merit-based scholarships, i.e. giving scholarships to students that earn above average grades.

http://www.investmentnews.com/article/20130510/FREE/130519999