Financial News Friday – September 27, 2013

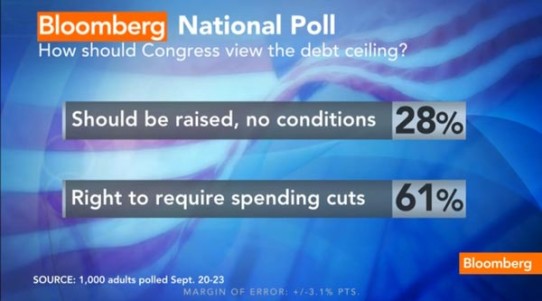

According to a Bloomberg poll, 61% of Americans believe that it is right to require spending cuts when raising the debt limit. (Chart is featured at the top of the post.)(Bloomberg)

The SEC continues to consider its options around the concept of a uniform fiduciary standard. This article also helps delineate the difference between a fiduciary and suitability standard. (CFA Institute)

A British broker-dealer ICAP, has been fined $87 million for the manipulation of the LIBOR (London Interbank Offered Rate) benchmark interest rate. LIBOR is used to determine the interest rate issued on many variable mortgages, interest rate swaps, and floating rate notes. (NY Times)

The US Postal Service is seeking to increase the price of a first class stamp to $0.49. However, the US Postal Service has had trouble turning a profit, with annual losses in the billions for the last few years. This article suggests that the solution is to charge $1 for first class mail. (Yahoo Finance)

Detroit will receive $300 million in federal aid to help restore some certainty to the bankrupt city. However, with $18 billion in liabilities during its bankruptcy proceeding, the $300 million may do little to squelch the city’s ailing finances. (CNN Money)

Here’s a CNN article describing 8 things to know about the debt ceiling. An interesting (which could be read as intuitive and thus highly unlikely to happen) proposition is to require debt increases to be passed at the same time the bill that would increase the national debt is passed.(CNN Money)