Financial News Friday – September 6, 2013

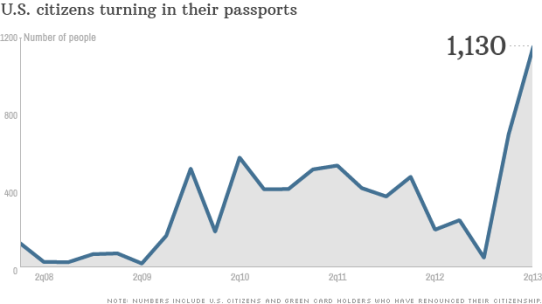

More US Citizens are turning in their passports before the Foreign Account Tax Compliance Act (a law that requires all international financial institutions to report all assets own by Americans to the IRS) goes into effect. As you can see in the chart above, there is quite a spike in renunciations in 2013. There were 1,130 renunciations in the first 2 quarters of 2013 versus a total of 932 in 2012. (CNN Money)

Carl Richards has a great post about “safe” investments. Oftentimes these “safe” investments are in fact complex financial products dealing in the financial derivatives market. So, even if you think you “know” someone, make certain that you understand the financial product you are being sold. (NY Times)

From the rumor mill…Larry Summers is still high on the list as the President’s pick for next Federal Reserve Chairman. (Fortune via CNN Money)

However, it seems Summers faces “Key ‘No’ Votes if Picked for Fed” (WSJ via Yahoo Finance)

J.P. Morgan Chase & Co. seeks to end its student-loan business, likely due to student loan revenues declining from $6 billion to $200 million in 2012 and its push to exit businesses it “no longer dominates.” The federal government, already responsible for 85% of the student-loan market, will likely take on the excess capacity. (Yahoo Finance)

Chicago Fed President Charles Evans says the Fed’s bonding buying program, known as quantitative easing, could begin decreasing monthly purchases later this year. Currently the Fed purchases $85 billion per month is fixed income securities. (MSN Money)

When people say things like this, it gives me pause. This is exactly the kind of language people were using right about the time Lehman Brothers went bankrupt. Morgan Stanley CEO “Gorman Says Chance of Another Financial Crisis Near Zero.” That reminds me of this quote from Warren Buffett “Be fearful when others are greedy and greedy when others are fearful” (Bloomberg)

Another Bitcoin (the completely electronic crypto-currency) exchange, Tradehill,’temporarily’ shuts down due to regulatory pressures. Bitcoin was relatively unknown to most people until the Bitcoin bubble earlier this year. Following the increased media attention to Bitcoin, many regulatory agencies have begun to further scrutinize the complex virtual currency and its users.(InvestmentNews)

Also, (almost) congratulations to my sister tomorrow, as she is getting married this Saturday.Now, I’m off to shoot some sporting clays and enjoy the pre-wedding festivities.

Photo Source: CNN Money