Market Update – September 12, 2016

Current Conditions

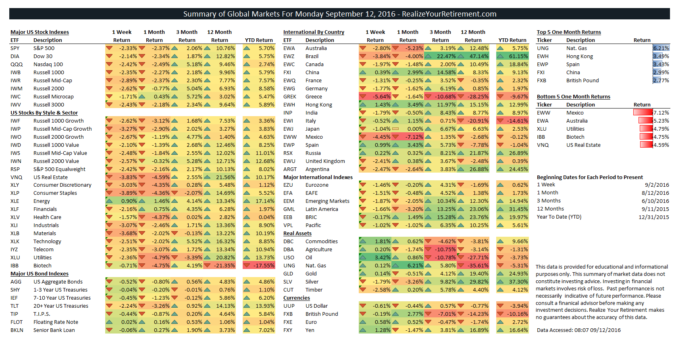

The markets have finished down over the past week with the S&P 500 down -2.33%, the Dow Jones down -2.14%, international stocks (EAFE) down -1.51% and US Aggregate Bonds down -0.52%.

Asset Classes

Top asset classes for the past week include Oil (3.42%), Commodities (1.81%), and Hong Kong (1.43%).

Bottom asset classes for the past week include Greece (-5.64%), Mexico (-4.45%), and Consumer Staples (-3.89%).

Top asset classes for the past month include Nat. Gas (6.21%), Hong Kong (3.49%), and Spain (3.43%).

Bottom asset classes for the past month include Mexico (-7.12%), Australia (-5.23%), and Utilities (-4.79%).

Economic Strength Index (ESI)

Updated on a monthly basis. (Chart may not display correctly via email.)

An ESI value of 32% indicates a:

Cautious Outlook

The ESI’s current value of 32% (down from 45%) indicates that the US economy is no longer in prime territory to support growth. While job numbers remain very strong and unemployment remains low several aspects of the US economy have begun to show their age in this market.

The ESI’s move to the low 30’s is a vote of caution. The economy is becoming more vulnerable to shocks. Should the ESI continue to maintain its low value or decline further, the likelihood of a recession will increase.

The levels of several indicators are still in fair territory (with a couple indicators in optimistic territory, mostly job numbers), while others are far below average. Year over year growth rates amongst the indicators underlying the ESI are in the 19th percentile (0 to 100 scale) down from the 21st percentile last month. This, combined with the current value of the ESI imply that we may see more softening of economic numbers to come.

Comments

US equity markets were down over the past week, with losses of -2.33%. The Consumer Staples (-3.89%), Real Estate (-3.83%), and Materials (-3.68%) sectors fell the most among US markets.The Energy sector was the only sector with a positive week with a gain of 0.90%.

International stocks had pockets of positive returns over the past week, many in emerging markets countries such as Spain (0.99%) , Russia (0.22%) and China (0.39%). Other international markets fared poorly, however. Greece (-5.64%), Mexico (-4.45%), Brazil (-3.84%), and Australia (-2.80%). The UK fared about the same as the US down -2.41%, while Japan was only down -1.04%.

Bond classes were also hit due to the remarks about raising interest rates from the Fed. Long Term Treasuries were walloped, down -2.24% for the week while the remainder of returns ranged from -0.44% for Inflation Protected Securities, -0.45% for Intermediate Treasuries, -0.52% for the broader bond market. Floating rate securities managed to eek out a slightly positive return at 0.02% for the week.

Commodities were the strongest asset classes. Commodities as a whole increased by 1.81% for the week, largely due to Oil prices which were 3.42%.

I’ll continue this refrain as long as we’re at the top of the markets. It’s easy to become over-allocated to stocks when markets are making new highs and the volatility of the last year is seemingly in the rear-view mirror. However, in times like these (when markets are reaching new highs) risk is at its greatest, so it’s important to maintain a balanced outlook in your portfolio.

When volatility increases, as it has in the past week, it’s best to make small changes to your portfolio, with each change moving your portfolio to a more comfortable allocation. Large changes often lead to regret and poor market timing.