Market Commentary – September 8, 2015

Last Friday the jobs report caused a lot of uncertainty in the markets. The numbers would keep the Fed on track for a September rate hike. Richmond Fed President Jeffrey Lacker wants to begin raising rates sooner rather than later, while “Bond King” Jeffrey Gundlach of Doubleline Capital estimates the chance of a rate hike this month at 25%. If the Fed hikes rates this month, it would likely be a small increase, with a larger one to follow next year. However, a rate could be a catalyst for degradation of the economy’s health, so we will continue watching the markets and act accordingly.

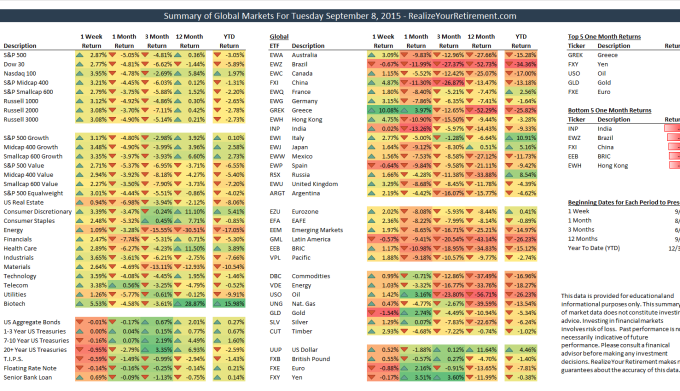

Summary of Global Markets for Tuesday September 8, 2015

Click the image above to zoom in and see the full Global Market Summary.

Economic Strength Index

This month the Economic Strength Index, the proprietary economic measure I developed to gauge the strength of the US economy, sits at 71% on the scale of 0 to 100. That’s a 5% jump from last month and is near the January reading of 75%. Should economic conditions deteriorate, equity positions in portfolios would be reduced as the ESI falls.

The market is still volatile, and we’re officially in correction territory, but with a recession unlikely, long term investments in individual equities are an attractive purchase.

Tactical investment strategies are likely to continue holding a large amount of cash in the near future.

This type of market requires the mental strength to stay committed to any plan that has money in the markets. However, the downside protection offered by risk management systems would prevent large losses from occurring in portfolios should the markets continue to slide. Expect more volatility in the weeks ahead, with continued large up and down days. It’s difficult to forecast what may come next, but based on current readings, but the likelihood of a bear market is low.

Historically after a correction such as this, the market tests new lows, but then then the market has typically rallied in the weeks and months following the correction. In the mean time stay committed to your systematic investment plan. Intra-year corrections like this are a fairly common occurrence in most bull markets. If the correction should change to a bear market, plans will adapt accordingly.