Market Update – August 22, 2016

Current Conditions

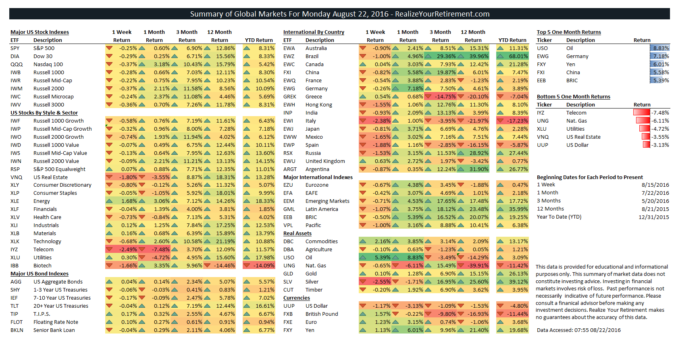

The markets have finished down over the past week with the S&P 500 down -0.25%, the Dow Jones down -0.29%, international stocks (EAFE) down -0.42% and US Aggregate Bonds up 0.04%.

Asset Classes

Top asset classes for the past week include Oil (5.39%), Commodities (2.16%), and Energy (1.68%).

Bottom asset classes for the past week include Silver (-2.55%), Telecom (-2.49%), and Italy (-2.38%).

Top asset classes for the past month include Oil (8.83%), Germany (7.18%), and Yen (6.01%).

Bottom asset classes for the past month include Telecom (-7.48%), Nat. Gas (-6.11%), and Utilities (-4.72%).

Telecom has continued its decline, falling a further -2.49% this past week, bringing its total 1-month return to -7.48%. While it has had a tough month for both Telecom and dividend-producing utility stocks, both are still positive for the year, with Telecom’s year-to-date returns of 11.57% and Utilities’ YTD returns of 17.98% still ahead of the S&P 500’s 8.31%.

Economic Strength Index (ESI)

Updated on a monthly basis. (Chart may not display correctly via email.)

An ESI value of 45% indicates a:

Neutral Outlook

The ESI’s current value indicates that the US economy is no longer in prime territory to support growth. While job numbers remain very strong and unemployment remains low several aspects of the US economy have begun to show their age in this market.

The levels of several indicators are still in fair territory (with a couple in optimistic territory), while others are far below average. Year over year growth rates amongst the indicators underlying the ESI are in the 21st percentile (0 to 100 scale). This, combined with the current value of the ESI imply that we may see more softening of economic numbers to come.

Comments

US equity markets end the week fairly flat, down slightly with the S&P 500’s return of -0.25%. Investors who have previously been heavy in defensive stock sectors such as Utilities and Telecom, and US real estate, have been rotating out of those sectors, trimming the gains of each for the year. There has been a rotation out of defensive sectors which can be indicative of increasing investor sentiment in the markets as investors move away from the less risky assets they piled into during volatile times to more risky assets as markets climb and they feel safer.

Bonds were mostly flat for the week and month with returns of US bond classes ranging from -0.17% for the US 10 YR to 0.17% for TIPS. Bonds remain a strong asset class for the year.

There have been declines in several emerging markets over the past week such as Italy (-2.38%), Russia (-1.53%), and Brazil (-1.00%), slightly reversing their strong returns over the past month.

I’ll continue this refrain as long as we’re at the top of the markets. It’s easy to become over-allocated to stocks when markets are making new highs and the volatility of the last year is seemingly in the rear-view mirror. However, in times like these (when markets are reaching new highs) risk is at its greatest, so it’s important to maintain a balanced outlook in your portfolio.