Financial News Friday – September 26, 2014

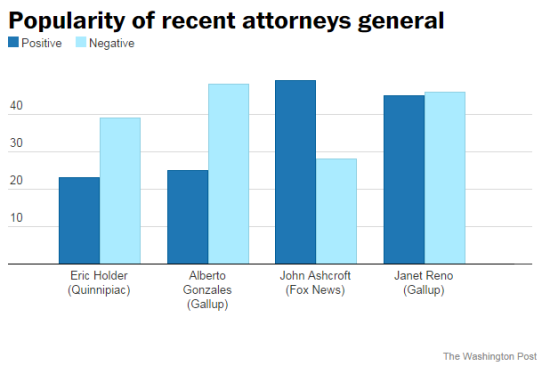

Holders Departs As A Pretty Unpopular Attorney General (Washington Post)

Eric Holder resigned from his position as Attorney General this week. He leaves office with only a 23% approval rating. (See chart above.)

IRS Shifts Course With New Rollover Distribution Rule (Investment News)

The IRS Has released new guidance on after-tax contributions to traditional retirement plans (e.g. normal 401(k)s, not Roth 401(k)s). Previously one would have to go through a series of steps to rollover after-tax dollars into a Roth IRA, those steps were decidedly not blessed by the IRS, which can always be a cause for concern. With the new guidance, we can directly rollover those after-tax dollar contributions (but not earnings from those contributions) from a retirement plan into a Roth IRA.

Jackson National Unveils Tiered Pricing For Variable Annuities (Investment News)

Jackson National has released a new five tier pricing system. Investors can choose a certain payout level and a certain annual bonus with step-ups. Jackson National intends to offer greater choice for consumers looking at these annuities. However, greater choice with already complex products can increase consumer confusion around what benefits they will receive for a certain tier and step-up.

A preliminary look at how the new pricing system works indicates that the Level 5 with a 7% annual step-up is equivalent to the parameters I included in my annuity review. Therefore the comments I made in the review remain unchanged.

New annuity reviews will be posted in the coming weeks, after I complete my work on Retirement Planning Academy. (Yes, it’s still in the works, I’ve simply had to restructure it several times due to various circumstances.)

Despite Curve Balls, Most Retirees Manage (WSJ)

Most financial planners recommend a retiree shoot for their post-retirement withdrawals and income to equal about 80% to 90% of their pre-retirement income. A T. Rowe Price study indicates that 52% of retirees were only getting 41% to 80% of their pre-retirement income.

As one retiree, Roger Burdette, 67, states “You think back to when you go to college and you don’t have a lot of money, so you’ve got to find ways to make it go farther,” he says. “It’s the same approach for retirement.”

Gen Xers Are Poorer Than Their Parents (CNN Money)

Gen Xers lag the wealth accumulation of their parents at the same age. Parents of Gen Xers had $65,200 in wealth at the same age, whereas Gen Xers only have around $30,530 and six times the debt of their parents.

Tax Refunds Will Be Cut For ACA Recipients (USA Today)

Up to 279,000 households could owe money to the IRS due to up-front tax-credit payments they received through the Affordable Health Care Act (ACA, also known as Obamacare) to help pay for health insurance. Mainly this is due to changes in income (many of those receiving tax credits work part-time) or changes in life (e.g. divorce and marriage)

Treasury, IRS Issue New Guidance to Curb Corporate Tax Inversions (Think Advisor)

The US Treasury and IRS have teamed up to use administrative rulings to make corporate tax inversions (where a company moves their headquarters overseas by merging with a foreign company) more difficult to accomplish. While this may achieve their goal in the short term it’s treating the symptoms of the problem instead of the underlying drivers, which are the US’s high corporate tax rates. Of course, revising the corporate tax code is something for Congress to accomplish squabble about.

15 Worst Cities for Retirees (Think Advisor)

WalletHub took stock of the largest 150 American cities and ranked them across 5 categories: affordability, activities, quality of life, healthcare, and jobs. Most of the top 15 worst cities are in the North-East and in California.

Some of the worst cities for retirees include Providence, Newark, Philadelphia, New York City, Chicago, Baltimore and Boston.

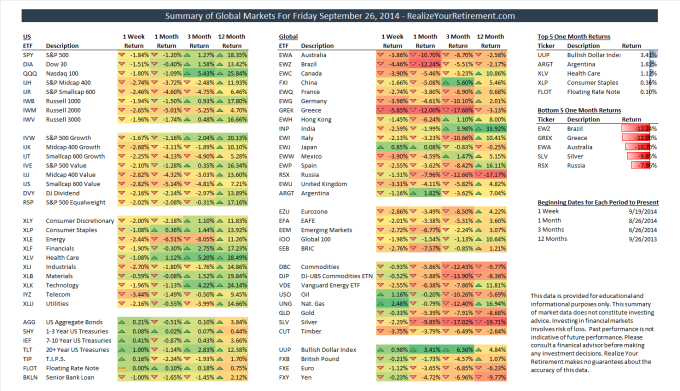

Summary of Global Markets for Friday September 26, 2014

Click the image above to zoom in and see the full Global Market Summary.